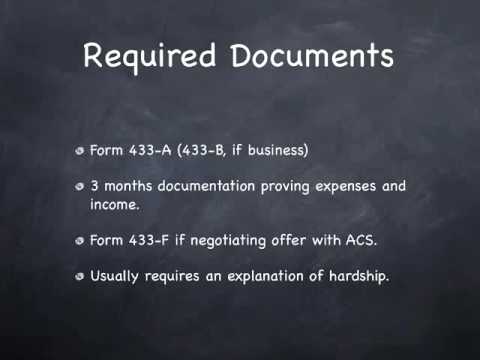

I owe the IRS a lot of money, and I'm temporarily unable to pay. This is a comment that I hear again and again in my practice, and so I thought I'd take this opportunity today to make this short video to explain what to do in this particular situation. My name is Darren Mesh, and I'm a tax attorney with an international tax practice based in Tampa, Florida. Now, this video is one of twenty videos, and if you'd like to have access to the other 19 videos, please visit our website at wowt.com. So, what we're talking about today is called hardship or currently not collectible status. Hardship status, also known as status 53 (sometimes with IRS folks if you want to impress them that you really know what you're talking about them about, you can indicate that you're asking for status 53), it has to do its some interior lingo at the IRS and it has to do with what screen that they're looking at. It happens to be screen number 53. But hardship or currently not collectible status is not really a solution for an IRS problem. It's not the be-all, end-all in most cases. But it's when the IRS agrees not to attempt to collect a tax debt for a specific period of time, usually a year or two. They will go ahead and go through your financial statement, and if there is no ability to pay indicated and proven with documentation on the financial statement, then they will agree to place you in this status for you, again usually a year or two at a time. It's a great immediate solution to protect yourself from collections. It will stop a levy. It will usually not stop the filing of a federal tax lien. That's important to note....

Award-winning PDF software

Where to fax irs 911 Form: What You Should Know

Taxpayer Advocate's Regional Office, please click here. For all other telephone numbers, including a telephone numbers fax number, please click here. You may also contact the nearest Taxpayer Advocate agency by phone or mail by visiting their website(link is for the state where you live). You may also find additional information about how you can obtain the help you need through the Taxpayer Advocate website here When filing a tax return, taxpayers should be prepared to provide supporting documentation to show their income, tax liabilities, and tax debts in order to verify eligibility. This is called the supporting documentation. A Form 8862 and the tax return due date to complete a taxpayer's tax return. Form 8862 — American Indian income tax return. Form 8862 — Native Hawaiian income tax return Form 8965 — U.S. citizen pension or annuity due Form 8965 — Form 8442 Social Security claim. Form 8965 — IRS Form 709 return or 844-S7-C (S-Corporation) return. Form 8966 — U.S. citizen retirement benefit Form 941, U.S. income tax return. Form 941 — U.S. income tax return. Form 944, U.S. foreign tax return. Form 940 — U.S. income tax return. Form 1040 — U.S. income tax. Form 1040 — U.S. income tax return. Form 1040 — Form 1040A (Individual Income Tax Return) Form 1040A — U.S. individual income tax return. Form 1040EZ — U.S. individual income tax. Form 2555 — U.S. income tax return. Form 2555 — U.S. tax return for dependents. Form 2947 — U.S. taxpayer with disabilities tax return. Form 2947 — U.S. taxpayer with disabilities tax return. Form 8562 — Tax preparer. Form 3800 — Taxpayer assistance program (TAP). Form 3800 — Non-emergency Medicaid Form 380 — Taxpayer Assistance Program (TAP) Assistance. Form 4506 — Taxpayer Information As you may already know, I am a Taxpayer Advocate for the California Department of Education (Called).

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 911, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 911 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 911 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 911 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Where to fax Irs Form 911